By Sam MacPherson MFTA, Head of Treasury at Earlytrade, originally published in Exchange Magazine

Environment, Social and Governance (ESG) is no longer emerging, the savviest of Treasury teams are getting on with it. ‘So, how do you deliver impact?’ asks Sam MacPherson, Head of Treasury at Earlytrade, the largest supply chain network in Australia and New Zealand.

After ‘Corporate Social Responsibility’ came ‘sustainability’ which soon became ‘social purpose’, but now ‘activist investors’ are just investors and ESG metrics are how they assess your companies’ economic value. That escalated quickly!

Well, kind of.

The concept of CSR has been around since the 1960s but more recently reporting standards have become formalised through the likes of MSCI and Sustainalytics as well as the “Big Four” accounting firms.

The quantification of ESG performance metrics has made the intangibles of just a few years ago tangible, measurable, standardised and of critical importance to attracting investment, sales and customer loyalty whilst avoiding unnecessary scrutiny.

But how do Treasurers take the ESG reins and deliver impact for their companies?

Treasury’s strategic edge lies within an organisation’s allocation of capital in the supply chain. More poignantly, a corporation’s costs and investments are the most underrated levers to proactively manage ESG risk and performance.

What does ESG spell for Treasurers?

For Treasurers and their teams, the impacts are diverse. Most notably, there is a clear liquidity management link to ESG with key aspects of the Treasurers’ role, such as how operations are financed and where excess cash is invested, having a significant impact on the value of a corporate’s reputation and, therefore, the willingness of stakeholders to support it and do business with it.

Certainly, BlackRock chief executive, Larry Fink’s Annual Letter to CEOs has year-on-year ratcheted up the investor community’s ethical worldview to the point where, doing well also means doing good.

Every company must not only deliver financial performance, but also show how it makes a positive contribution to society.

LARRY FINK, BLACKROCK CEO

Whilst green financing has undoubtedly been a focal point, an increasing number of investors are applying stricter criteria across each of the ESG factors when determining their portfolio selection.

According to the SIF Foundation, in 1995, the U.S. sustainable and responsible investment universe had approximately $639 billion in assets under management. That number has now surpassed $11.6 trillion.

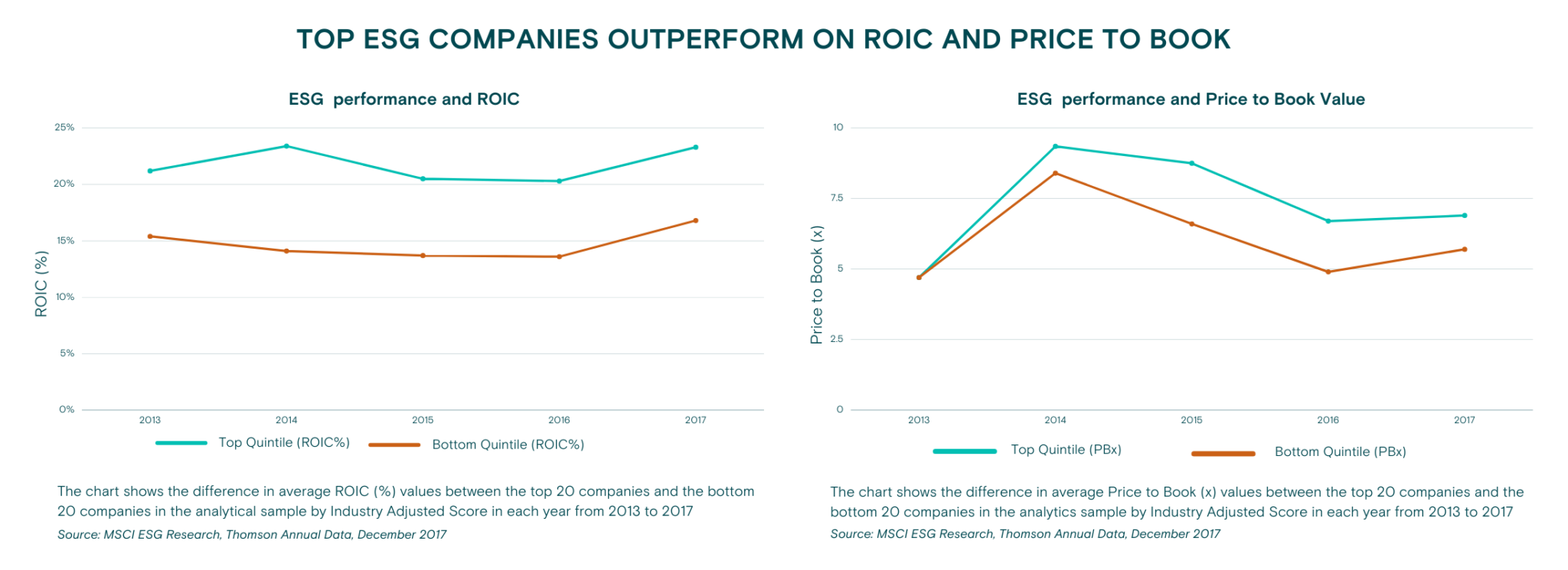

Reassuringly, a 2018 MSCI report concluded that companies with strong ESG Ratings exhibited a “higher return on invested capital and price to book multiple versus their lagging counterparts.”

This trend has increased again as those millennials that senior executives have been keeping an eye on are no longer wide-eyed university students; they are the talent they want to employ, the investors they want to attract and the customers they want to sell to.

New risks for Treasurers — where to start?

Globalisation and the outsourcing of labour have seen supply chains stretch to all corners of the globe, successfully driving costs down but also sacrificing supply chain transparency. This new risk was apparent in the disastrous Suez Canal blockage that hit pause on 10 percent of global trade and the semiconductor shortage that has forced GM and Ford to temporarily idle factories across North America.

Treasury teams around the world are being asked, or will be asking themselves, what is our exposure to these types of events?

It is not enough anymore to only report your organisation’s compliance with the growing list of regulations and policies… corporates also now need to understand their suppliers’ compliance positions and exposures.

It starts with understanding the make-up of your supply chain.

It is not enough anymore to only report your organisation’s compliance with the growing list of regulations and policies such as Modern Slavery Act, the Payment Times Reporting Act, Net Zero commitments, state-based Security of Payment Acts, as well as critically important support for local and Indigenous suppliers. Overwhelmingly, corporates also now need to understand their suppliers’ compliance positions and exposures.

Whilst “greening” the supply chain is certainly the macro pressure, Treasurers and their CPOs must also manage the inevitable and more directly material risk of supplier default, particularly in the post-pandemic economy.

How you manage the efficiency and flexibility of your trading relationship with your suppliers has a huge impact on their ability to deliver for you, maintain your plant and equipment, innovate products to delight your customers, and importantly, keep the shelves stocked with toilet paper!

The obscurity of supply chain networks makes it near impossible to identify and validate the business ethics of tens of thousands of suppliers that might make up a corporate supply chain. This creates new risks that savvy corporate Treasurers must manage to fulfil their ESG obligations.

The complexity for many large corporates is the accurate identification and verification of eligible and compliant suppliers within their convoluted supply chain, often managed using off-the-shelf technologies and supplier portals developed for overseas markets.

Performing this task in perpetuity is manual and backbreaking for many organisations, not to mention hugely imprecise. When considering the full spectrum of supply chain policies and regulations the risks to a Treasurer’s ESG mandate become considerable and should not be left until the worst-case scenario materialises before being analysed, quantified, and managed.

Tapping the efficiency of the network effect

Treasury strategies must evolve to incorporate the growing needs of the ESG landscape. That landscape is different for each industry and each business depending on the make-up of its supplier base. However, there is substantial overlap from business to business and industry to industry.

Strong and well capitalised suppliers equate to a strong corporate supply chain, in turn creating new economic value and, ultimately, shareholder returns

Earlytrade’s network of 50,000+ businesses offers a substantial opportunity for efficiency, where many suppliers are already verified as small, medium, Indigenous and/or local businesses.

Digitisation and automation like this can certainly enable efficiency of ESG reporting, but businesses must also consider reputation value and risks of their activity. A pertinent example of this is corporate behaviour within the supply chain.

Traditional supply chain finance and reverse factoring methods have long been used to simply increase DPO/DSO for large corporates, but these are no longer fit for purpose and are increasingly viewed as unacceptable strategies.

Supply chain solutions must now be tailored to unlock value for all participants throughout the supply chain whilst providing an assurance of liquidity throughout the business cycle. Earlytrade combines industry leading supply chain visibility with fair and equitable early payment solutions for all suppliers in the chain.

Strong and well capitalised suppliers equate to a strong corporate supply chain, in turn creating new economic value and, ultimately, shareholder returns.