The extensively publicised collapse of Greensill in March 2021 caused many onlookers to question the broader supply chain finance industry and the way in which it functions.

Collateral damage from these events may also extend to hesitation among decision-makers when accessing unrelated supply chain technologies for the organisations, including investments desperately needed to eliminate analogue systems that are crippling their own suppliers.

Distinct from any supply chain finance or reverse factoring product, Earlytrade’s corporate partners maintain complete control and gain new flexibility of working capital management through the technology platform, as opposed to engaging third party financiers and attracting exposure to credit risk.

With Earlytrade Marketplace, large firms – as depicted in the following client case studies – are able to invest their own cash-at-bank into their supply chains in the form of on-demand invoice payments, as opposed to low-yield money market deposits. This provides suppliers with a much needed source of simple and affordable liquidity over which they have complete control and total discretion.

What makes Earlytrade’s offering unique is that customers like Lion, not third-party financiers, fund the early payments. The discount rates available through this platform are significantly less than those offered via bank financing or credit cards, and this is particularly true in the case of small businesses.

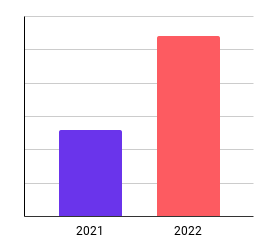

RBA figures show that average small business interest rates are between 6.09 percent to 7.92 percent (depending on the loan type), while average interest rates on revolving personal credit range from 10.03 percent to 19.94 percent.

“It can be as quickly as 24 hours that they put [payment] in, and that would be a three-day turnaround. We might negotiate with Earlytrade to get an 0.8 percent discount on my payment, but I might actually get a 1.2 percent discount if I pay my invoice early. It’s working with small numbers but it adds up over time.”

Emily Hickson, Port Macquarie Workwear (Lion supplier)

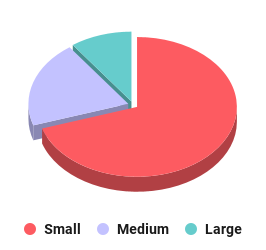

Sixty-two per cent [of Lion’s suppliers] are using invoice tracking each month and 36 percent have used the early payments function at some stage. On average, in any given month, nine percent of our suppliers opt to request early payments via Earlytrade. This is comprised of different suppliers each month, based on the individual requirements of each business.

Case Study 2: Coles deploys Earlytrade automation tech to eliminate COVID cash flow headache

During the depths of the pandemic in 2020 Coles Group’s liquor suppliers had cash flows crippled from on-premise entertainment site shutdowns, and retail stores hit with unprecedented demands from panic buying that cleared shelves.

Coles Group General Manager of Finance, Shane Healey, selected Earlytrade to develop and design a unique roll-out strategy for customised supply chain technology that would see the supermarket giant successfully manage the crisis.

Coles’ liquor division was heavily impacted by COVID-19 lockdowns and reduction in on-premise drinking. Demand in that division went from very high demand to almost nothing overnight. Coles wanted to make liquidity available to suppliers of this business, but had responsibility to its shareholders to focus the working capital distribution to those who needed it the most. Coles implemented the Earlytrade Marketplace solution which gave their suppliers an additional way to get on-demand liquidity, without unnecessarily committing working capital to its entire supplier base who were not all necessarily in need.

“We use Earlytrade with all of our Coles Group invoices. With a shorter cash flow cycle, we are able to reinvest much needed cash back into the business to fuel our growth.”

Milton Rum Distillery (Coles Group supplier)

Moreover, Coles’ liquor division did not have a supplier portal meaning their Accounts Payable team was regularly receiving calls from supplier Accounts Receivable teams requesting clarity on invoice statuses and payment times. Earlytrade customised its supplier portal, Earlytrade View, to provide end-to-end cash flow management for Coles suppliers, from invoice approval status to streamlined communication and, ultimately, access to on-demand liquidity.

“Huge win for our business. We had a lot less supplier queries; suppliers were much happier that they could see that.”

Shane Healey, General Manager of Finance, Coles Group

Automated supply chain segmentation

The first product that we looked to implement with the Earlytrade team was Earlytrade Verify… which was a way for us to understand who our small suppliers were. We didn’t have to get our suppliers to give us financial information.

Shane Healey, General Manager of Finance, Coles Group

Case Study 3: Asahi assures automated on-demand cash flow relief for suppliers during pandemic

After Asahi introduced Earlytrade Marketplace to its suppliers in November 2019, suppliers reported that the ability to autonomously and anonymously reduce payment times to as frequently as one week had allowed them to increase the amount of work they could deliver for Asahi.

“Earlytrade has provided some relief to a business and industry with a very tight cash flow.”

Letter from transport & logistics supplier to Asahi

In March, after lockdowns had been in play for only a month, transport suppliers were relaying the impacts of additional stress, compounded by restricted access to traditional business finance such as overdrafts. In the same month, on-demand payments in the Earlytrade platform increased by 650%, accessed by suppliers across the client based in order to simply and affordably bolster their cash positions heading into the unprecedented period.