Earlytrade is a platform that provides suppliers with access to early payments, helping you improve cash flow for payroll, materials, and equipment while offering visibility to invoice statuses and estimated payment dates.

Eliminate cash flow gaps and reduce financial stress by accessing working capital when needed to cover payroll, purchase materials, and invest in equipment.

Avoid the need for invoice factoring or high-interest loans, streamlining financial operations.

Invest in new opportunities and improve project readiness with predictable cash flow.

Work with contractors who prioritise your financial health and success, fostering loyalty and trust.

Registration was incredibly easy. I’d happily recommend Earlytrade to anyone else, without a doubt. No paperwork, no training – very, very simple.

When we first were contacted by Earlytrade I was almost skeptical about how easy the process was that was explained to me. We have found that it is realistically as easy as jumping onto a website, finding the rate which is acceptable on the day and clicking a button.

Earlytrade has really enhanced our working relationship with our clients and the visibility of data and the availability of funding has really made a big difference to the way our business operates.

Gain real-time visibility into invoice statuses and estimated payment dates, ensuring better cash flow forecasting.

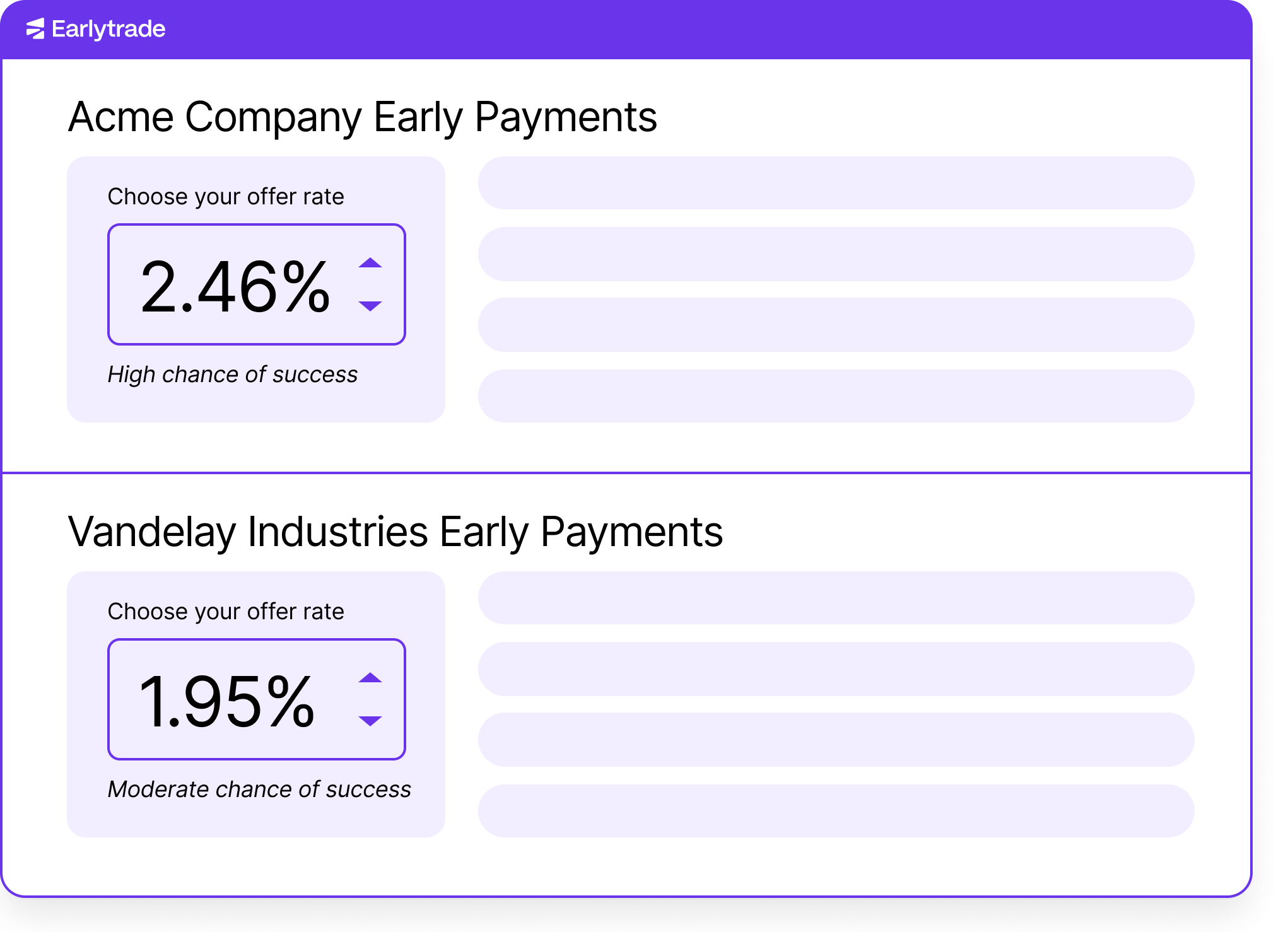

Choose whether to request early payment invoice-by-invoice, and set your own discount offer rates.

There is no mandate or cost to use Earlytrade, only the discount you choose to accept in exchange for early payment.

Companies that launch Earlytrade value the relationships they have with their supply chain. Earlytrade provides you with visibility into approved invoices and estimated payment dates, and provides on-demand, debt-free access to working capital.

Nothing in your claim/invoice process changes — continue to submit the same way you do today.

Your customers will still pay you the same way as always; only sooner if you opt to access on-demand payment.

It is free to use the Earlytrade supplier portal. Discount rates for on-demand payments are set by you.

Businesses utilize early payments to invest in new equipment, smooth seasonal fluctuations, manage cash flow during lockdowns or crisis events, and more.

Unlike traditional means of business finance, you do not need to put up any security or submit further details and credentials. This is the benefit of having strong supply chain relationships.

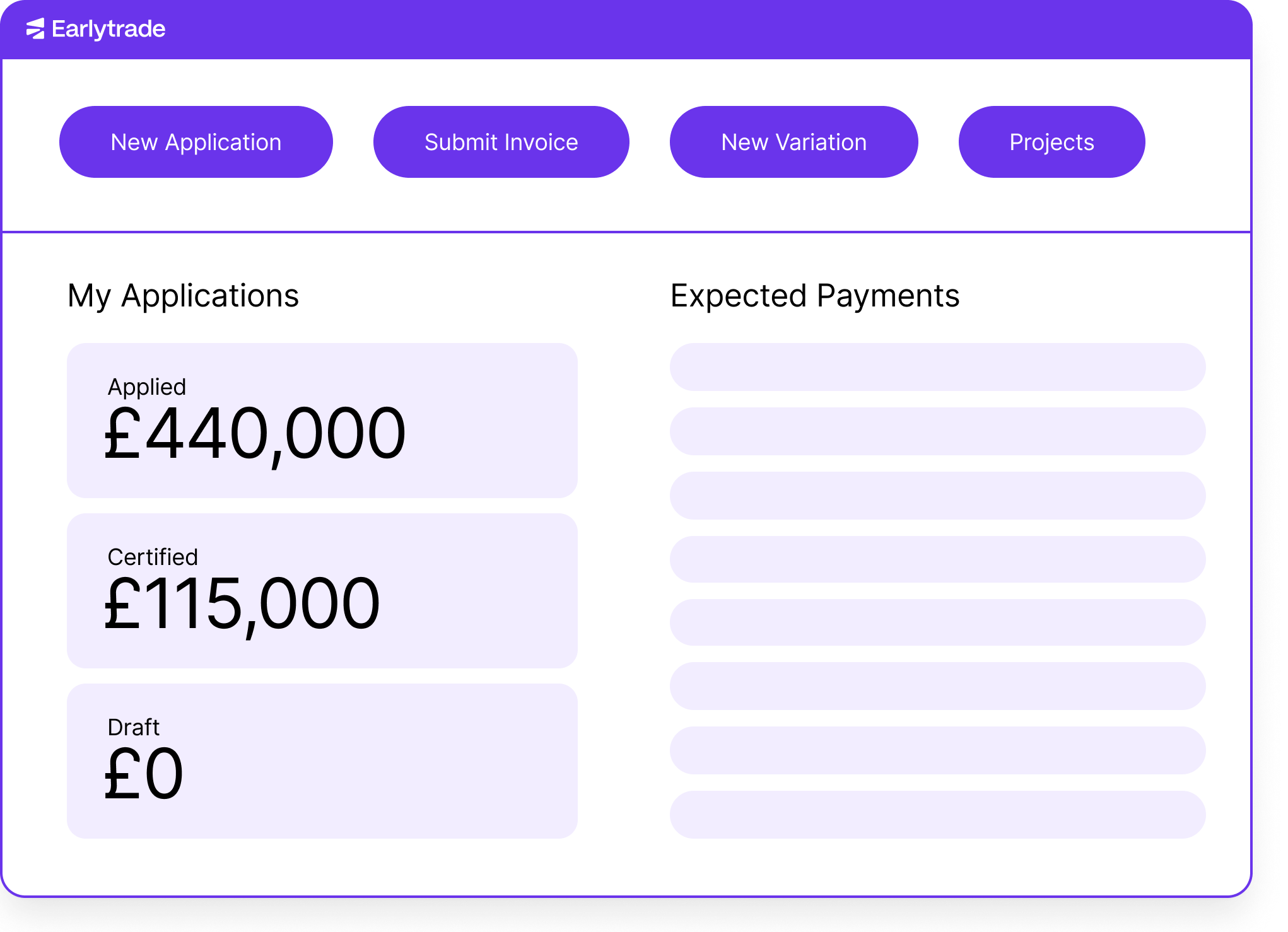

Our application for payment platform is free and easy to use, making it simple for suppliers to submit claims without extra costs or complexity.

Submit and access AFPs completely free of charge.

View your open application status instantly, no phone calls required.

Upload once and Earlytrade tracks expiry automatically.

Sign and submit documents quickly without paperwork delays.

Communicate directly on the platform for faster responses.

1

Quickly request new variations

2

Attach relevant insurances and documents required for applications

3

Get instant confirmation that all steps and documents have been received